AI-Driven Risk Assessment for Modern Insurers

Smarter Underwriting through AI-powered Risk Assessment — Fast, Clear, and disease management solution for insurers, enabling a holistic and explainable approach to underwriting. Our platform turns data into production-ready decisions with speed and clarity.

ryskIQ Platform

AI-driven underwriting platform — superior risk insights, precise approvals, fewer requirements; sales uplift, top-line expansion, stronger quality, and loss reduction.

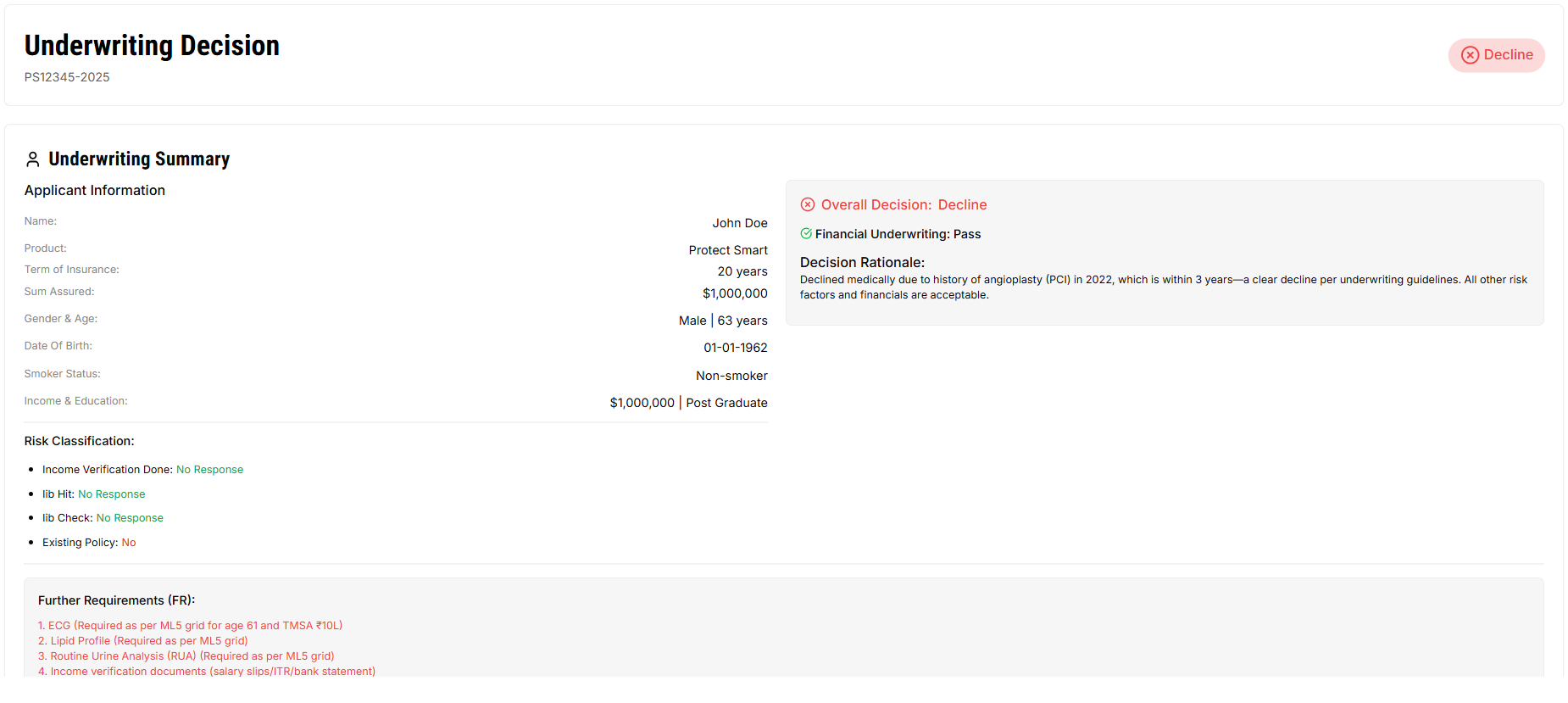

Underwriting, Automated

Transforming data into accurate underwriting decisions.

Underwriting Time

From 6.8 mins to 2 mins – 240% efficiency gain.

Non-core Tasks

87% efficiency gain by eliminating non-core tasks.

STP Uplift

Increase STP by 38%, cut manual reviews.

Policy Admins System Integration

Seamless integration with workflows and automated underwriting guardrails.

Accuracy

Agentic AI ensures audit-grade accuracy.

Less Evidence, Faster Decisions

Cut additional evidence requests by 75%.

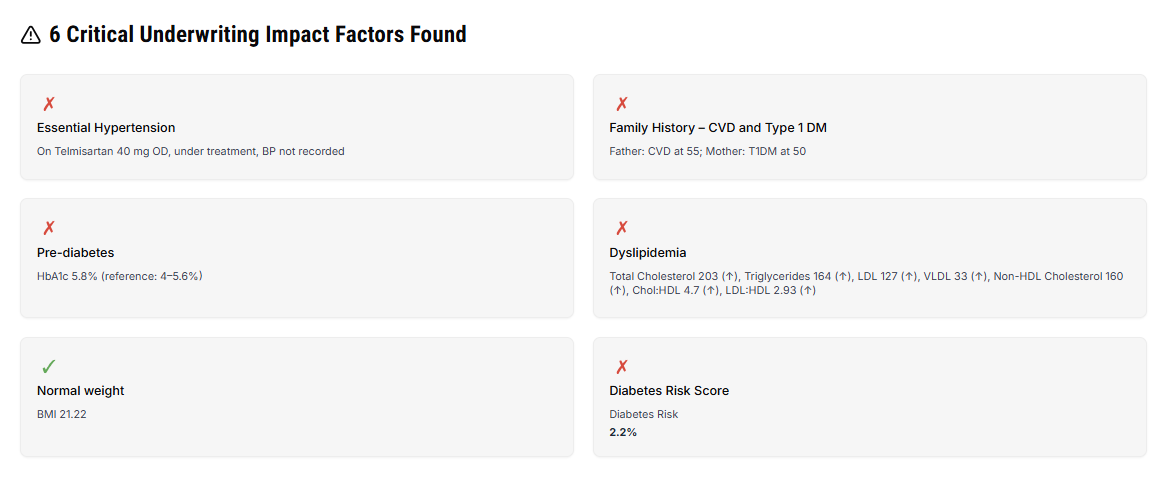

Smart Quantified Summaries

Explains every decision with quantified factors and Smart Summary.

Transforming Underwriting

AI-powered underwriting platform using GLM and risk scores.

Intelligently triages and underwrites STP cases.

Efficiency: Human-in-the-loop workflow enables 200+ cases/day/underwriter.

Delivers 99% data accuracy; flags errors and mismatches.

Always on underwriting with average decision processing time of 40 secs.

Case-level summaries of key risk factors for loss ratio monitoring.

Product

What We Offer

Tailored to your risk appetite, backed by best-in-class underwriting tools and standards.

Customizable solutions

Faster Implementation

Works 24X7

Trust

Secure. Transparent. Unbiased Underwriting Intelligence.

How we deliver on security, transparency, and fairness

Every data point is encrypted in transit and at rest, housed in a SOC 2- and ISO 27001-compliant environment. Our engine logs every transaction, surfaces explain-as-you-go rationale, and lets underwriters inspect factors before approval.

Independent actuarial audits and continuous fairness checks guard against bias, while role-based access and zero-retention of sensitive fields keep your data safe and private. The result: provably secure, fully traceable, and impartial underwriting decisions your compliance team can sign off on with confidence.

Get in Touch

Write to us at [email protected] or fill the form below.